Indian Overseas Bank LBO Recruitment 2025

Indian Overseas Bank (IOB) has announced the recruitment of 400 Local Bank Officers (LBOs) for the year 2025. This presents a valuable opportunity for graduates aspiring to build a career in the banking sector. Below are the key details of the recruitment:

Indian Overseas Bank LBO Recruitment 2025 Overview

- Post: Local Bank Officer (LBO)

- Total Vacancies: 400

- Application Mode: Online

Application Period: 12th May 2025 to 31st May 2025

- Job Location: Across various states in India

- Official Website: www.iob.in

- Important Dates

- Notification Release Date: 9th May 2025

- Start of Online Application: 12th May 2025

- Last Date to Apply: 31st May 2025

- Last Date for Printing Application: 15th June 2025

Eligibility Criteria

- Educational Qualification: Graduation in any discipline from a recognized university.

- Age Limit: 20 to 30 years as on 1st May 2025. Age relaxation is applicable as per government norms.

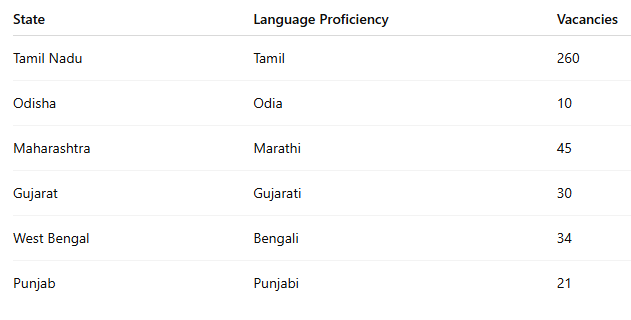

State-wise Vacancy Distribution

- Application Fee

- General/OBC/EWS: ₹850/-

- SC/ST/PwBD: ₹175/-

- Selection Process

- Online Examination

- Language Proficiency Test (LPT)

- Personal Interview

- Official Notification

For detailed information, see official notification: IOB LBO Recruitment 2025 Notification pdf

- How to Apply

Visit the official website: www.iob.in

- Navigate to the ‘Careers’ section.

- Click on the link for ‘Recruitment of Local Bank Officer 2025-26’.

- Register and fill in the application form with the required details.

- Upload necessary documents and pay the application fee.

- Submit the application and take a printout for future reference.

Q1: What is an IFSC Code?

Ans: IFSC stands for Indian Financial System Code. It’s an 11-character alphanumeric code issued by the Reserve Bank of India (RBI) to uniquely identify every bank branch that participates in digital fund transfers. IFSC codes are essential for online transactions such as NEFT, RTGS, and IMPS. You can find your IFSC code using our Home or Search By Bank Name page.

Q2: Why is the IFSC Code important in online banking?

Ans: The IFSC code helps route your transaction to the correct branch. Without it, online transfers may fail or be delayed. It ensures that the money reaches the exact destination branch without manual errors or confusion.

Q3: What is a MICR Code?

Ans: MICR stands for Magnetic Ink Character Recognition. It is a 9-digit numeric code used to identify banks and branches that are part of the Electronic Clearing System (ECS), especially for processing cheques faster.

The MICR code is printed on the bottom of cheques and helps in the secure and fast clearing of physical instruments.

Q4: What is a SWIFT Code?

Ans: You can find the SWIFT code on your bank’s official website (Ex: State Bank of India) or by contacting your branch. Alternatively, our platform will soon include SWIFT code search tools to make your task even easier.